The complex equations used to model the economy and create the federal government budget have too many variables and uncertainties for there to be a single right answer.

But proposed solutions can be evaluated against our objectives and basic principles (the Math) to identify wrong answers and take appropriate corrective actions when needed. The hope is that we can create practical solutions that address key issues identified by Occupy movements (and others), and put in place sensible, stable economic policies.

Recent government efforts

Since the 2008 election, the federal government has enacted legislation in response to a major recession and to address related pressing issues – such as providing TARP (Troubled Asset Relief Program) funds, increasing the national debt ceiling (twice), extending the temporary tax cuts enacted in 2001 and 2003, and more recently extending low interest rates on student loans. But there has been no progress toward creating a comprehensive, sustainable budgetary solution to the nation’s financial woes.

The Path to Prosperity

The latest federal budget proposal was submitted to Congress in March by the House Budget Committee, chaired by Congressman and Vice Presidential candidate Paul Ryan (R-Wis.). This proposal includes a combination of tax cuts for high-income earners and corporations along with significant reductions in funding for Social Security, health care, food stamps and education for the poor. Proponents claim this budget, titled The Path to Prosperity, will improve the efficiency of government services and result in an economic recovery which, in turn, will fuel job growth. Opponents have characterized this budget as a partisan statement of conservative policies as opposed to a practical legislative proposal.

Simpson-Bowles

The most recent comprehensive proposal for government spending and tax reform was produced by the 18-member Simpson-Bowles Commission (NCFRC), appointed by President Obama in 2010. Named after co-chairs Alan Simpson (R-Wyoming) and Erskine Bowles (D-former White House Official in the Clinton administration), the Commission arrived at proposals to simplify the tax code, overhaul government retirement and health care programs, and implement fiscal controls for reversing the growth of government budgets and debt. See a full summary.

Though endorsed by 11 of the 18 members of the Commission, the Simpson-Bowles proposal succumbed to political gridlock and failed to move forward. Dave Cote, CEO of Honeywell, was a member of the commission and taped this summary of his expereince and views. Here’s a clip of Erskin Bowles and Alan Simpson explaining the proposal on Meet the Press (9/14/2012).

A simple income tax model

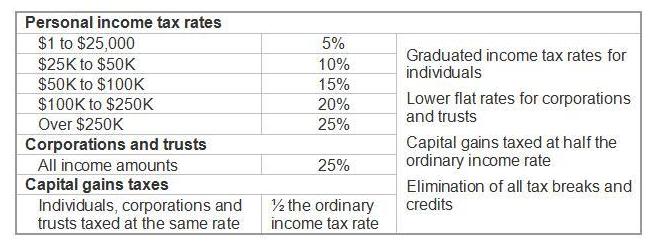

Consider this simplified income tax structure built from the basic principles given on the Math page and featuring a “semi-flat tax” taken from previous reform proposals.

Income tax structure – Everyone pays

In this example, everyone pays some tax on income beginning with the first dollar received whether from an employer or government source. Since everyone benefits from the services and protections provided by the government, it follows that each of us responsibly contribute to their costs.

In this example, everyone pays some tax on income beginning with the first dollar received whether from an employer or government source. Since everyone benefits from the services and protections provided by the government, it follows that each of us responsibly contribute to their costs.

Tax breaks and credits are eliminated, limiting the government’s ability to influence free-market forces by favoring one product or company over another. Eliminating tax breaks and incentives also diminishes opportunities for special interest groups and lobbyists, reducing the potential for legislative favoritism and corruption. And simplified tax codes would enable significant streamlining of Department of the Treasury revenue agencies, reducing government expenses.

This model reduces the U.S. corporate income tax rate to levels competitive with other nations. Low income earners would pay for their use of government infrastructure and services, and higher income earners would pay slightly higher rates on regular income while retaining the present reduced tax-rate on capital gains. Based on data available for 2010, income tax revenues of almost $2 trillion would be generated compared to less than $1.3 trillion actually collected.

How would you do it?

Despite decades of work by respected experts and government officials, the U.S. does not have a viable, tong-term tax and spending plan in place today. What’s your view? If you had the power, what policies or solutions would you propose for resolving the nation’s financial challenges?

Here’s a fun budget modeling tool you can use to try out your ideas.

Contribute to this forum for rational solutions – no matter how specific or broad your idea may be.